Can you remember a time when you got a check from your health insurance company?

Late October to November is open enrollment for most employees, a time to review and renew employer-dased health insurance. I was in the process of reviewing my list of benefits when I saw something unfamiliar: Hospital Indemnity. After a few moments of confusion, I turned to Google then went to the Insurance website to learn more about the benefits of hospital indemnity. To my surprise, my hospital stay in January for my gall bladder surgery was covered and I wasn’t even aware that I had insurance to help cover the deductible. Here I am finding out 10 months later! I called the insurance company to find out if it was too late to file a claim and was pleasantly notified that I still had time to file. I got my check less than one week later.

The purpose of insurance is to transfer risk. Health insurance is insurance against the risk of incurring medical expenses among individuals and a health insurance policy is a contract between an insurance provider and an individual or sponsor. Most people don’t realize the importance of a good health insurance policy until they suddenly have a medical crisis or emergency and need it the most.

Many people do not have the option of an employer group health insurance policy and may become overwhelmed when attempting to choose the right health insurance policy that fit their needs and budget. With my benefits package, I am able to choose “add on” coverages such as accident coverage, cancer coverage, and the hospital indemnity coverage.

Here are a few things to consider when choosing health insurance:

- Choose your insurance company wisely: Experts say that it’s better to pick a general insurance company over one that offers life insurance. A life insurance company will not be focused on health insurance and their policies usually cost more.

- Make an informed decision: Ask questions and read all that you can about the various options your health insurance company is provide.

- Check the in-network hospitals: Check which hospitals are under the insurance company, check their specialty, reputation and distance from your home. In an emergency, you are most likely to visit a hospital closest to your home.

- Understand the premium calculation process: A premium is an amount you pay to the insurance company for the policy. Talk to your insurance agent about the amount of premium you will have to pay per year and how the company will charge for various services.

- Read the fine print (clauses): Reading them well is very important and do ask questions. Consider pre-existing conditions and exclusions.

- Go through reviews and compare policies: In the event of a medical emergency, it is important that you and your family have complete peace of mind when it comes to finances.

- Check flexibility of the policy: Some companies allow the insured to have some flexibility in paying the premium for the amount used.

- Check if the company offers a no-claim bonus or discount: If you haven’t claimed any insurance in the policy year, some companies offer either a bonus amount or a discount on the premium in the next year. This is a good feature and also an incentive to keep fit and healthy.

Health policies in the United States:

The United States health care system relies heavily on private health insurance, which is the primary source of coverage for most Americans. According to census.gov:

- In 2012 about 61% of Americans had private health insurance.

- In 2014, 89.6% had health insurance coverage: 66% had private health insurance coverage and 36.5% had government coverage.

- 55.4% employer-based insurance

- 19.5% Medicaid

- 16% Medicare

- 4.5% Military health care

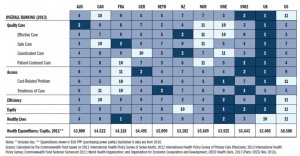

Healthcare Comparison by Countries:

For a better view and more information, please click here: Comparison

To Your Success,

Althea

Althea A. McLeish Wilson, RN, MSN

Promoting inner health & outer beauty!

Did You Find This Helpful? If so, please feel free to share!